Context: I'm writing this blog post to describe the role and interaction of the players that make a self-funded health plan work.

The audience for this post is an intelligent business leader who is curious and wants to know a bit more detail than what the average broker can or will provide.

At Yuzu, our #1 value is honesty. We never treat you like you "can't handle the truth". That said, it's not necessary you understand everything in this post in order to make good decisions about health insurance. But, we believe every business leader should understand a little more about the way they spend healthcare dollars than they do now.

Prereq: The basics of self-funding and how it differs from fully-insured arrangements.

Short explanation: Self-funding looks and feels the same to plan members as a fully-insured plan and offers the same financial protection and care.

It is more flexible and adaptable, though, which can give more options to employers who are tired of the status quo.

High Level Diagram

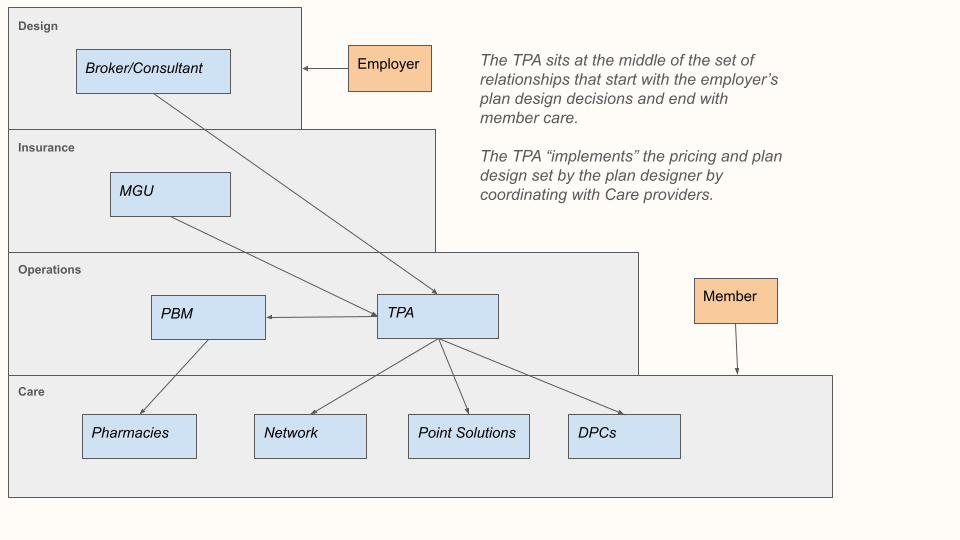

The below diagram links parties that work together in operating a self-funded health plan.

There are four parts of running a plan:

Designing the plan

Insuring the plan

Operating the plan

Caring for members

Each is handled by a separate party or set of parties that combine to form something that is cohesive to members and employers.

This should not be scary. This should be cool.

Role #1: The "Plan Designer"

The role of the Plan Designer is to design the benefits and cost-sharing of the health insurance plan to achieve the goals of the customer (the employer).

This task always includes three goals (deemed the Iron Triangle of Healthcare):

Reducing costs (for both the member and the employer)

Improving access to care

Improving quality of care

In practice, the plan designer considers other goals as well like building a plan that is simple to understand, market, and administer.

"Designing" a health insurance plan is very hard since these goals are in conflict. The plan designer's job is to make the right tradeoffs based on the customer's needs.

Examples of questions they consider:

Is it worth adding pre-authorization requirements for various procedures if it reduces cost by X%?

How do I ensure I have access to the highest quality providers? How much will this cost?

What sorts of drugs should I have on the plan's formulary? How much should members pay in coinsurance for their share? Should I reward members who switch to generic drugs? Should I penalize members who don't?

Should I raise the deductible to ensure that premiums don't go up this year?

Employers don't usually know that much about healthcare and usually are not able to make these tradeoffs well, so typically a broker or consultant will evaluate and consider plan designs.

Talking to employers honestly about these tradeoffs is something the industry is typically very bad at doing. If you accurately describe a tradeoff to a potential employer-customer but your competitor glosses over that trade-off and overpromises, then there is a chance you lose the business.

The role of plan designers is very hard. It is oftentimes impossible to accurately determine how much cost savings certain plan changes will actually affect. And the types of plan designs and cost saving measures that are effective change continually as laws, regulations, and innovations keep adding hurdles and opportunities for Plans.

This is part of the reason that health insurance can feel very dishonest.

The role of the plan designer is similar to that of a government policymaker. The goal is to write a policy that balances fairness and utility for the plan members (analogy = citizens).

Since everyone at the company pays for benefits through lower wages, the health insurance plan needs to be prudent about how it spends its money.

Role #2: The "Underwriter"

The role of the underwriter is to figure out the price of insurance that the company will pay. They then issue a stoploss contract that insures the obligations of the Plan.

How does the underwriter determine your businesses insurance price in a self-funded environment? You can think of them as building and computing a mathematical function.

As inputs, the underwriter has a census of the group and the plan benefit levels.

From this they estimate the expected cost of claims and then add in a margin for their services.

Different underwriters will give different prices because of different assumptions they are making about expected claims costs. Some underwriters will give credit to certain cost-reduction strategies embedded in the plan (such as increased access to primary care or cheaper prescription benefits).

Most underwriters are MGUs which is short for "Managing General Underwriters" (alternate name "Managing General Agents") for insurance companies. There are many reasons that insurers distribute through agents, including because insurance is still a personal business where working through agents allows policy customization and relationship building.

MGUs typically get compensated in two ways:

They get some amount of money for underwriting each policy.

They share in the underwriting profit/loss of the business. So they are incentivized to write good business that has lower claims than premiums.

After issuing a policy, the underwriter must of course pay claims. The TPA is responsible for submitting claims and appropriate documentation to the MGU and processing the accounting related to filing the claim.

An MGU's job is hard. They are asked, with little information, to take on theoretically unlimited financial risk for a relatively small premium.

Role #3: The TPA ("Third Party Administrator)

The TPA is responsible for administering the health plan. "Administering" is a broad term, and the TPAs duties often get confused with those of other parties.

The TPA will quite frequently be blamed for things mostly outside of its control. It will be blamed for the price of insurance being too high (this price is mostly set by the MGU). The TPA will be blamed for benefits denials (even when the plan designer chose to exclude those benefits from the Plan).

TPAs do deserve to be held to a high standard, but it is first worth understanding what it is that they do.

The TPA has the least sexy job in the stack. The following tasks are a good summary of what TPAs do.

Task #1: Be the Source of Truth

The TPA is the source of truth for everything in the health plan: Benefits, Payments, Claims Decisions, Eligibility. It must make this information available to relevant parties.

Benefits must be communicated to members.

Eligibility must be sent to other parties (e.g. the PBM or network) and received from the employer.

Claims information must be compiled into reports so that Plan Sponsors and insurance companies can understand the financial performance of the plan.

Task #2: Interpret the plan document to process claims

The TPA has a similar role to a referee or a judge. It does not decide the rules (design the plan). But it is responsible for calling off-sides.

When a claim comes in, the TPA must look at plan language, eligibility, and previous member claims to determine how much the plan should pay (versus the remainder left to member cost-sharing).

Task #3: Integrate the health plan

The TPA serves as the middleware between a lot of other parties. Most venders do not ever talk to each other, for example the DPC will not ever talk to the PBM or need to exchange data with them. Instead, everyone talks to the TPA who is responsible for maintaining a source of truth with the correct access permissions so that every party can obtain and modify the correct parts of the health plan.

Other venders that must be integrated: network and utilization management.

The TPA also facilitates conversation between other parts of the plan stack. They will typically "market the stoploss", meaning shop around for stoploss rates by providing stoploss MGUs a census and benefit design.

Task #4: "Compliance"

The TPA takes on compliance duties for the Plan Sponsor. Compliance is surprisingly complicated since health plans are regulated by several different departments of the Federal Government. These include the Department of Labor (since the "benefits" are compensation) and the Department of Health and Human Services.

Besides submissions to satisfy these agencies, the TPA also pays PCORI taxes on behalf of the plan, provides or furnishes COBRA administration, maintains HIPAA security and privacy notices, and ensures that the Plan's claims procedures comply with consumer protection laws.

Role #4: The PBM ("Pharmacy Benefit Manager")

The PBM's role is to handle all aspects of the plan's prescription drug benefits.

This includes the "plan design" component of the prescription drug plan (called the formulary) which decides which drugs are covered and within which tiers. Should Ozempic be included? With what prior auth?

This also includes the "adjudication" component. For pharmacy claims, the adjudication is handled at the pharmacy counter, so the PBM needs to immediately be able to make coverage decisions.

PBMs also establish the network of pharmacies members are able to use, and handle pharmacy related customer support.

There are many great articles out there about the hidden ways that many PBMs make money.

The most common is spread pricing, where PBMs do not share the full extent of their rebates with plan sponsors and instead make money on the difference between the cost they procure the drugs at and the amount they charge the plan. When PBMs engage in this practice, they are incentivized to cover drugs for which their rebates are high, even if other similar or equivalent drugs can be acquired cheaper.

At Yuzu, we work with SmithRx since they are transparent in their pricing and take a per-script fee while sharing all their rebates back with the plan, eliminating conflict of interest.

Role #5: The Utilization Management Vender

Utilization Management is the umbrella term for ensuring that medical services received are medically necessary.

This includes three things:

- Prior authorization for certain procedures

- Concurrent review of expensive events, including monitoring inpatient stays

- Retrospective review, to determine after-the-fact whether a course of treatment was necessary.

Often seen as evil, this part of the health plan is especially necessary in today's word where hospitals and physicians submit claims to plans (instead of insureds submitting their own claims), since those actors are oftentimes financially incentivized to bill for unnecessary services.

Determining medical necessity is an inherently subjective job. To add standardization, Utilization Management venders use Evidence Based Guidelines published by reputable firms like Milliman.

These guidelines are written by physicians and stay current with medical best practices. Claims denials for medical reasons are signed off by physicians.

https://ae.milliman.com/en-gb/health/evidence-based-guidelines

The TPA is responsible for looping in the Utilization Management vender when necessary and forwarding eligibility information to them.

Role #5: The Network

A network is a set of trusted providers who offer discounted rates to plan members.

This concept is perhaps the most misunderstood in the benefits world, and many people confuse the network with the insurance company itself.

The job of a network is to ensure that members have access to care at predictable and affordable rates.

Modern networks are totally failing at this mission, and increasing costs along the way.

Network contracts are negotiated a few times:

Providers negotiate contracts with networks. Bigger providers with more leverage are able to get better rates than smaller providers. Rates are typically negotiated as a global percentage of what Medicare pays. So one independent physician may be able to obtain 90% of what Medicare pays for its panel, while another with more leverage could obtain 150% of what Medicare pays. Commercial (company-sponsored) plans typically pay more than Medicare.

Networks negotiate prices with insurance plans. These rates are based again on leverage. Larger plans (with more members) are able to obtain more concessions. These rates are oftentimes not transparently shared with plans.

I am particularly biased against networks. See my explanation -->

Advocates of networks see healthcare as a game that can be negotiated, and not one where services should be shopped. They believe that scale is better than value. I don't believe that secretive agreements should guide patient care. I am an outlier in this industry.

Role #6: The "Point Solution"

A "Point Solution" is a vague and general term in the health benefits space. It can be generally defined as any plan add-on that is targeted at increasing cost, quality, or access in a specific benefit category.

Examples include:

- Special networks that handle high-cost services (e.g. transplant networks)

- A telehealth app that is paid for by the plan with the goal of reducing other costs

- Educational materials or programming that teaches members how to utilize care at appropriate levels (e.g. Quizzify)

These point solutions don't generally integrate well with or replace current benefits. They typically struggle from low-utilization.

In theory point solutions are a great idea. In practice, the process of selecting quality point-solutions based on the data that they share about their effectiveness is difficult.

There is often a stark difference between the ROI estimates in their marketing materials and the end-effect on plan spending.

Larger employers typically have a better way of measuring their performance than do smaller employers.

Summary: It's a Complicated World

Do you, an employer, need any of this to run a health plan?

Legally, no. It may be surprising, but you don't need a network or stoploss or a hired benefits advisor or TPA.

ERISA (a 1974 law) protects your right as an employer to just declare benefits. You are still constrained by a few provisions on how those benefits are structured and administered.

In fact, this is how employee benefits used to work. Bills were received by members who took them to employers for direct reimbursement. No middlemen. This is perhaps not feasible anymore, but it is important to remember that that is where this whole mess started from.

How much of this should employers actually understand?

If you're an employer that read this post, you're doing better than average.

In such a complicated world, a guiding principle is to understand how each of these pieces works and makes money. This will help you ensure that everyone you're contracted with is making a fair amount of money, and not deceiving you for profit.

Traditional brokers want you to stay dumb and accept healthcare costs as out of your control. They don't have to be.

Healthcare is complicated, but it isn't as complicated as it seems.