About: this is meant to be a collection of links and external resources relating to TPA stuff, but also a sort of memo about what self-funded insurance is and how it works. Most people have no idea how self-funded insurance works.

United Healthcare makes >$5B PROFIT per quarter. They can make this money because most of their customers don't understand self-funding.

Ground floor: What is self-funded insurance?

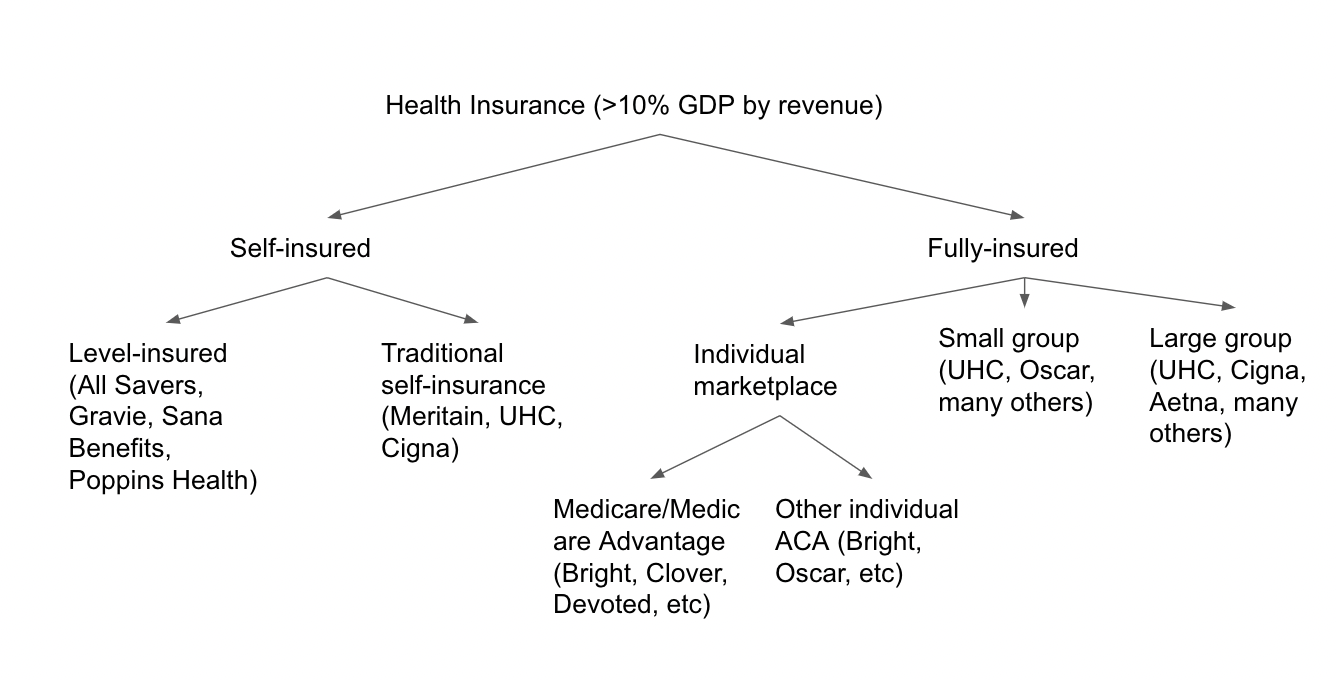

There are two categories of insurance, fully-insured and self-insured. These categories relate to health insurance, but also other types of insurance companies might buy for employees (including workers' comp, vision, dental, etc)

1. Fully-insured Policies

Insurance company collects fixed premium from every insured individual

Insurance company takes ownership over all claims, subject to cost-sharing

Can be bought on individual exchanges (B2C) or as company (B2B)

Regulated by federal laws like ACA and state laws (e.g. "community rating" rules)

2. Self-insurance

Strictly B2B, historically only available to large businesses

Legally, company issuing benefits is fully responsible for insurance claims

Company can buy insurance to cover its insurance obligations to limit downside

This insurance is called "stop-loss insurance". It is essentially reinsurance.

Only regulated by federal laws

Only need to satisfy MES (Minimum essential coverage) ACA laws

Must satisfy ERISA rules too, but these are less restrictive on plan design

3. Level-funded insurance

Is self-funded insurance combined with a financial product

Best of self-funding's "low-regulation" plus fully-insured's "high-predictability"

Solves for problem of companies wanting monthly payments (like fully insured)

self-funded stop-loss policies being over a full year

Just self-insurance with a financial product that makes yearly payments feel monthly

Better for small businesses who

can't take variability on balance sheet

are comparing product to fully-insured options

Fun fact: almost all large employers self-insure. Because of this, 64% of Americans with employer-sponsored insurance (non-Medicare, non individual-marketplace) are on a self-funded plan. src

Mezzanine: Why go self-insured?

There are four reasons to go self-insured:

In fully-insured plans, one of the things you pay for is renting capital

Renting insurance capital is expensive, more than similar bonds would cost

...so expensive there are whole companies devoted to lowering capital costs

e.g. Aegle Health Partners, Ledger Investing

For big companies with large balance sheets, saving on capital rent is huge

There are many fewer regulations that pertain to self-insured plans

ERISA pre-emption means that states cannot add rules to self-insured plans

In other markets, every state has their own rules

Can underwrite health benefits to the company's specific risk pool

healthier companies can get cheaper rates, which they can't do usually

in most insurance plans, rates are fixed in advance and same for everyone

in self-insurance, groups can get a custom price

the mechanics of how this works are sketchy (will write follow-up here)

MOST EXCITING FOR STARTUPS! Benefit plans can be customized and dynamic

There has been huge innovation in consumer health-tech products

e.g. One Medical, Forward, Tia, Wearable devices, etc.

biggest problem = new benefits not generally covered by insurance

legally can be covered, but more complicated and insurance co's are slow

current solution = redundancy

~60% of technology companies add ancillary benefits (e.g. Ginger, ClassPass)

this spend could be native part of health plan

growing pains solved

can customize plans (e.g. add support for new geography) easily

previously would have had to switch providers

Most exciting as a software engineer

self-insured plans own their claims data, and can smartly adapt spending

companies that sponsor fully-insured plans have no ability to see trends

claim data = insurance co property

in self-insurance, the insurance company is legally just the employer

Mid-floor: Downsides?

Complexity

Many questions must be answered, and any one wrong choice = landmine

network -- which one to rent (based on geography, employee needs)

ancillary -- buy any other services based on employee health needs?

stop-loss provider and contract terms

Require experienced HR leader willing to take risks. Not common.

Possibility of higher costs

Although self-insurance saves money on average, it has more variance

for some groups there is literally no risk though, depends on stop-loss

More work

In self-insured plans, the company must adjudicate claims and do compliance

Technically, the company can just hire a TPA to do this work, but that's work too

Top-floor: Additional resources?

1st vid of youtube series that is very helpful on stop-loss market

two podcasts I binge to for news about self-funded space